Collection Services

Definisci le migliori strategie di gestione e recupero del credito

Liquidity

+25%

increase in credit recovery

Collection Time

-30%

reduction in DSO

Fidelizzazione

-15%

decrease in customer churn rate

A structured method to maximize recovery

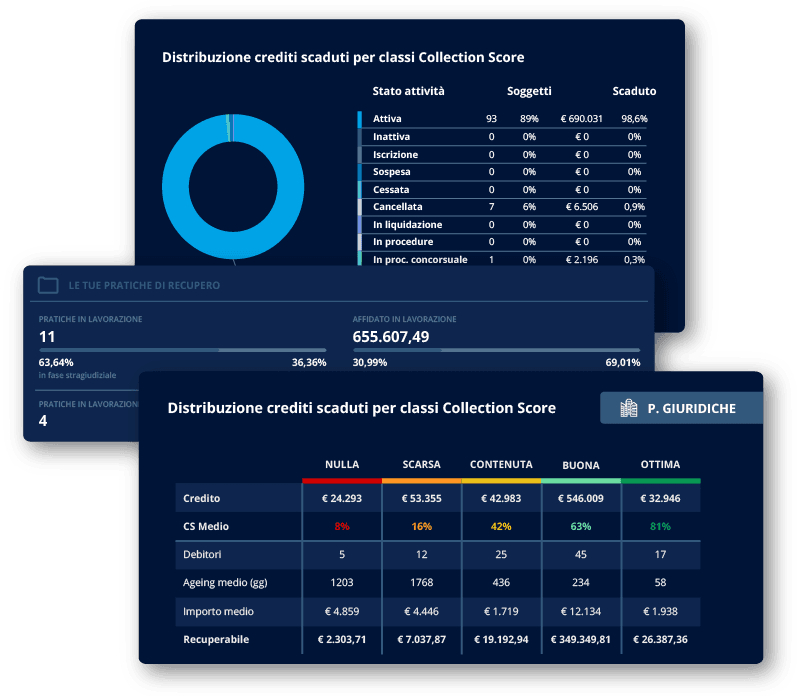

Credit Collection provides a suite of specialized services focused on recovering commercial and banking debts. From estimating the recoverability of outstanding debts to managing claims, judicial and legal procedures, we support you throughout the entire process with dedicated structures, industrialized processes, and an advanced platform that encodes the optimal actions to maximize performance.

The synergy between Business Intelligence, Data Management, and Operations allows us to adopt a strategic and scientific approach, ensuring flexibility and results in a short time.

End-to-end process to manage all collection activities

Our services include:

- Credit Analysis to conduct an analysis of potential default risks on the credit portfolio and segment it into groups with common characteristics, to apply the best management strategy.

- Extrajudicial Collection for a comprehensive management from the onset of non-payment to deterioration, from reminder and negotiation activities by phone to potential cases of home visits or sending legal notices.

- Legal Collection for a cost-effective management, starting from assessing the legal enforceability based on the debtor's assets, to defining settlement agreements during the monitoring phase, and concluding with an executive phase tailored to the debtor's financial capacity.

- International Collection to develop a targeted strategy addressing the specific needs and international context of foreign customers, in collaboration with mediators, legal firms, and selected partners in each country. diatori, studi legali e partner selezionati in ciascun paese

Features

Q&A

What is the first step in the debt collection process?

We conduct a preliminary evaluation of the outstanding debt, analyzing the specific situation to estimate recoverability and define the most effective strategy. We segment portfolios based on common characteristics and apply proven models based on historical collection data.

How long does it typically take to recover an outstanding debt?

It varies depending on the complexity of the case and the strategy adopted. Generally, thanks to our evaluation models, processes, and experts, we are able to reduce collection times by up to 30%.

How do you ensure flexibility in the debt collection process?

The process is tailored to your needs and formalized within an Economic Operational Project (PEO) that outlines actions, timelines, and costs.

How can I monitor the status of my debts during the recovery process?

We provide transparent access: our platform allows you to track your debts and receive detailed updates on the recovery progress.

How do you ensure the confidentiality and security of my clients' data?

We use advanced security protocols and comply with all data protection regulations to ensure that information is safeguarded at every stage of the recovery process.

Find the right service for you

© 2025 Cerved Group S.p.A. u.s.

Via dell’Unione Europea n. 6/A-6/B – 20097 San Donato Milanese (MI) – REA 2035639 Cap. Soc. € 50.521.142 – P.I. IT08587760961 – P.I. Gruppo IT12022630961 - Azienda con sistema qualità certificato da DNV – UNI EN ISO 9001:2015