DetectION

Revolutionize anti-money laundering management with AI

Efficiency

+87%

increase in productivity when managing suspicious activities

Accuracy

+70%

Identification of false positives in anomaly detection

Precision

+30%

increase in accuracy in detecting hidden anomalies with AI

The platform that revolutionizes the management of anomalous operations through AI

DetectION is an AI-based platform that enables better, faster, and more cost-effective decisions in anti-money laundering (AML) management through the integrated use of customer data and Cerved data, dynamic risk profiling, and the digitization of the entire process.

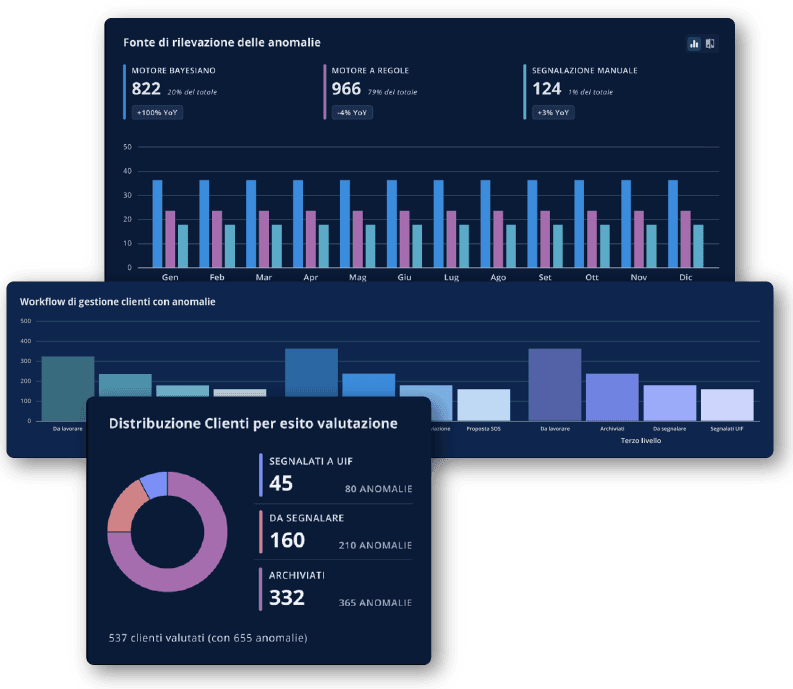

DetectION's efficiency in action

The platform uses AI algorithms developed by our AML experts and digitalizes the entire workflow to simplify operations and enhance efficiency.

DetectION reduces the risk of penalties by detecting anomalies more accurately and increases productivity by prioritizing investigation activities, supporting decision-making with AI-generated insights, and using Network Analysis as an advanced investigative tool.

Artificial Intelligence serving AML

The process of managing anomalous operations has been revolutionized thanks to the integration of a Bayesian AI model that allows you to:

- Prioritize anomalies detected by the rule-based engine and filter out false positives, focusing attention on alerts with the highest AML risk

- Identify more complex types of anomalous activity (false negatives) that cannot be detected by the rule-based engine alone, ensuring greater regulatory compliance

- Integrate Machine Learning techniques that continuously optimise the Bayesian model, enabling it to learn from the AML department's evaluation experiences and recognize new, uncoded money laundering patterns.

Features

Q&A

How can DetectION improve timeliness?

Thanks to Machine Learning, AI learns from the AML department's evaluation experiences to recognize new, uncoded money laundering patterns, generating continuous qualitative improvements that enable the detection of suspicious activities without waiting for the codification of new money laundering practices.

How does DetectION ensure greater compliance adherence?

The Bayesian AI engine performs daily analyses of the customer base, filters out false positives produced by the rule-based engine, and detects more complex hidden anomalies (false negatives), reducing the risk of penalties.

How does Network Analysis improve anomaly verification?

Graph technology enables enhanced investigations into subjects involved in anomalous activities, including both internal and external of the intermediary relationships based on official Cerved data. Network Analysis enables a deeper examination of connections between individuals and helps identify complex money laundering networks, intercepting suspicious relationships.

Increase efficiency in anti-money laundering processes with DetectION!

© 2025 Cerved Group S.p.A. u.s.

Via dell’Unione Europea n. 6/A-6/B – 20097 San Donato Milanese (MI) – REA 2035639 Cap. Soc. € 50.521.142 – P.I. IT08587760961 – P.I. Gruppo IT12022630961 - Azienda con sistema qualità certificato da DNV – UNI EN ISO 9001:2015