Hawk

This solution integrates all anti-money laundering processes into a single workflow

Accuracy

- 80%

false positives in alerts

Automation

- 80%

manual tasks in anti-money laundering processes

The modular suite to fulfil anti-money laundering regulations

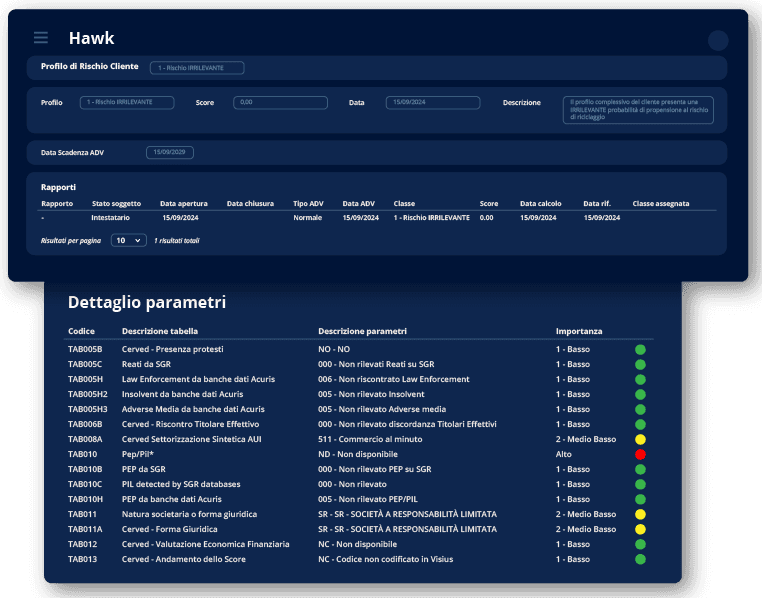

Suite Hawk is a customizable solution that allows you to fulfil all anti-money laundering regulations, from client onboarding to continuous monitoring, reducing team workload and costs.

The suite adequately checks and monitors the subjects recorded or identified in the Cerved database, within Visius and on anti-money laundering and anti-terrorism watchlists, calculating the risk for each subject based on subjective and objective parameters.

The solution also lets you fulfil record obligations for transactions in the standardized archive (ex Archivio Unico Informatico – Unique IT Archive) and the mandatory reporting of suspicious transactions (SOS) to the Financial Intelligence Unit/Bank of Italy.

Suite Hawk Components

The platform is divided into 4 highly customizable modules to meet anti-money laundering requirements:

- Suite Hawk AML to manage the entire check process, customer risk profiling, self-assessment, and activity monitoring. Transaction monitoring is done through a rules engine configured based upon the anomaly indicators provided by the Bank of Italy, along with manual indicators that can identify any suspicious transactions.

- Suite Hawk AUI to comply with the obligations of establishment, management, and maintenance of the Unique IT Archive (AUI) in accordance with deadlines and submission ways.

- Suite Hawk ADE to manage mandatory notices to the Italian Revenue Agency regarding the registry of relationships, data archiving and maintenance, notices for tax monitoring, and the management of noticed relations to Fondo Unico di Giustizia (Justice Fund).

- Suite Hawk FATCA-CRS to report information to the Italian Revenue Agency on transactions and relations of U.S. residents and those related to the Common Reporting Standard.

Features

Q&A

Is Suite Hawk easily adaptable to my business?

Yes, the modules are customizable to meet different regulatory and market needs.

How can I avoid false positives?

Thanks to the integration between AML lists and Cerved data, the Suite significantly reduces the number of cases to review, focusing only on events that are worth considering

In the event of an audit, can I have access to the documentation of the investigated position?

Yes, the platform digitally stores all documentation from the start of the relationship to check phase.

How can I totally view the portfolio risk?

You have access to all the reports related to the money laundering risk profile for each position, as well as by risk classes, providing a real-time snapshot of your risk exposure.

Is it possible to obtain a report on AML carried out analyses?

Yes, you can obtain all the report list, even the annual self-assessment report on money laundering and terrorist financing risks.

Use a single tool to comply with anti-money laundering regulations: choose Suite Hawk!

© 2025 Cerved Group S.p.A. u.s.

Via dell’Unione Europea n. 6/A-6/B – 20097 San Donato Milanese (MI) – REA 2035639 Cap. Soc. € 50.521.142 – P.I. IT08587760961 – P.I. Gruppo IT12022630961 - Azienda con sistema qualità certificato da DNV – UNI EN ISO 9001:2015