Credit Portfolio Monitoring

Manage and monitor your non-performing loan (NPL) through an algo-driven solution

The platform that helps you effectively manage your non-performing loans

Credit Portfolio Monitoring provides you proprietary data, predictive algorithms, and customized models to understand the causes of NPL and define the best management strategy.

The implementation of coded standards and specialized algorithms let you make more knowledgeable and scientific decisions, automate processes and monitoring, manage credits proactively and continuously evaluate the economic effect of credit risk on the portfolio.

A solution designed for specific use needs

Credit Portfolio Monitoring is divided into two different sections to support Loan Managers' operations and provide strategic insights to Top Management:

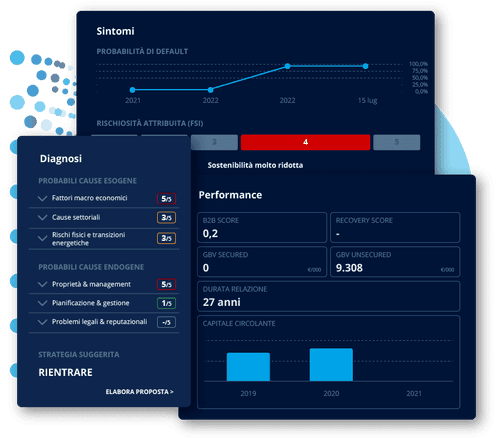

• Diagnostic allows the Loan Manager to evaluate the performance, signs and causes of each debtor's crisis within the portfolio, leading to the definition of a management strategy

• Portfolio Monitoring enables bank and corporate senior positions to monitor the evolution of the risk linked to the portfolio.

Features

Q&A

How can Credit Portfolio Monitoring improve my productivity?

The platform reduces the time needed to get and analyse information, speeds up decision-making processes, and accelerates the arrangement of deliberative files.

How is the diagnosis and decision-making process carried out?

Specific algorithms and scores can analyse personal data, economic performance, and the signs and causes of the debtor's crisis. All data are included in a standardized resolution document, partially automated and partially completed by managers.

Can I always be notified about portfolio risk changes?

Of course! Monitoring alerts notify you of any changes in positions and assess which signals are primary.

Analyse, monitor, and promptly manage critical situations in your portfolio!

© 2025 Cerved Group S.p.A. u.s.

Via dell’Unione Europea n. 6/A-6/B – 20097 San Donato Milanese (MI) – REA 2035639 Cap. Soc. € 50.521.142 – P.I. IT08587760961 – P.I. Gruppo IT12022630961 - Azienda con sistema qualità certificato da DNV – UNI EN ISO 9001:2015